Financial Planning and Analysis (FP&A) is far more than just crunching numbers. It is a strategic function that offers business owners critical insights into their company’s performance, assisting you in shaping a forward-looking plan.

By evaluating past performance, forecasting future trends, and guiding informed decisions, FP&A has the power to strengthen your business from multiple angles.

Explore What FP&A Entails

Below, we explore what FP&A entails, why it matters, and what can happen if you fail to leverage its benefits.

Understanding the Role of FP&A

- Strategic Forecasting: FP&A involves creating financial models that predict revenue, expenses, and cash flow over a set timeframe. These projections help you anticipate and adapt to changing market conditions.

- Performance Analysis: FP&A teams monitor key performance indicators (KPIs) and assess them against benchmarks. This enables leaders to make adjustments that maintain or boost profitability and efficiency.

- Resource Allocation: Whether you’re allocating budget to marketing, operations, or research, FP&A ensures resources are channeled to the areas with the highest potential for ROI.

Key Benefits of FP&A

- Informed Decision-Making: By interpreting financial data within the broader market context, FP&A supplies the knowledge required to make solid, strategic choices.

- Risk Management: Well-constructed financial plans identify where potential risks lie and allows you to develop contingency plans before problems arise.

- Improved Cash Flow Management: Effective FP&A ensures you have the cash to meet short-term obligations and fund long-term initiatives.

- Organizational Alignment: When each department understands the financial strategy, teams can work toward shared, measurable goals that support overall company growth.

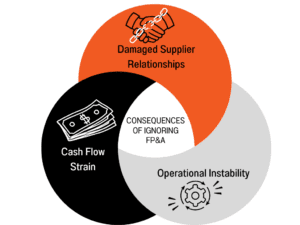

The Consequences of Ignoring FP&A: A Cautionary Tale

Consider a small manufacturing company that grows its product line without conducting thorough FP&A. The company overestimates product demand without accurate forecasts, leading to an expensive inventory surplus. At the same time, it underestimates production costs because it lacks a system to monitor real-time expenses.

After a few months, it experiences:

- Cash flow strains due to unsold products that tie up capital, and overhead costs creep up without a clear mitigation plan.

- Damaged supplier relationships and eroded trust and goodwill occur due to delayed payments caused by limited cash reserves.

- A weakened cash position causes operational instability. Maintaining production, paying employees, and funding new projects becomes a significant challenge.

Without FP&A, you might face substantial losses, damaging prospects for future growth or even survival.

Getting Started with FP&A

Now that you understand why financial planning and analysis is crucial, here are four key steps to help you set up an effective FP&A framework and begin seeing real results.

- Establish a Clear Framework: Define your financial objectives and determine the metrics you’ll track. This might include revenue growth targets, profit margins, or customer acquisition costs.

- Invest in the Right Tools: Use financial software or cloud-based solutions that integrate with your accounting systems for real-time data access and reporting.

- Build a Cross-Functional Team: Collaboration among finance, operations, marketing, and other departments ensures that budgets and forecasts are both accurate and actionable.

- Review and Adjust Regularly: Update your forecasts and budget allocations based on new data. An agile approach allows you to pivot when the market shifts.

Beyond Raw Figures

Financial Planning and Analysis goes beyond raw figures—it shapes strategy, reduces risk, and points the way to sustainable growth. Without a robust FP&A process, your organization risks misallocating resources and stumbling into preventable financial pitfalls.

By instituting a solid FP&A framework, you position your business for longevity and success in a constantly shifting marketplace. Reach out to our team if you’re ready to take your bookkeeping beyond the numbers.