Financial Planning and Analysis (FP&A) and Controllership are critical functions for business owners aiming to maintain robust financial health and strategic growth. One significant decision that you face is whether to manage these functions in-house or outsource them to specialized service providers.

Let’s explore the cost implications of each option to help you make an informed decision.

In-House FP&A/Controllership

Managing FP&A and Controllership in-house involves employing a team of financial professionals dedicated to these functions. Here are the key costs associated with this approach:

- Salaries and Benefits: Full-time employees require competitive salaries, benefits, bonuses, and potentially, stock options.

- Training and Development: Continuous professional development is essential to keep the team updated with the latest financial regulations and tools.

- Software and Tools: Investment in financial software, analytics tools, and other necessary technology.

- Recruitment Cost: Hiring skilled professionals can be expensive and time-consuming.

- Infrastructure: Office space, equipment, and other overhead costs.

Tips for Managing In-House Costs:

- Optimize Team Size: Ensure the team is neither understaffed nor overstaffed. Right-sizing can save costs and improve efficiency.

- Leverage Technology: Use advanced financial tools to automate repetitive tasks and enhance productivity.

- Invest in Training: Focus on targeted training that directly benefits your FP&A and Controllership functions.

- Monitor Performance: Regularly review team performance and adjust strategies accordingly.

Outsourced FP&A/Controllership

Outsourcing these functions involves hiring third-party service providers who specialize in FP&A and Controllership. This approach has its own cost structure:

- Service Fees: Payment for services is typically based on a fixed fee or hourly rate, depending on the scope and complexity of the work.

- Scalability: Outsourced services can be scaled up or down based on business needs, potentially reducing costs during slower periods.

- Expertise: Access to a team of experts without the need to invest in their ongoing training and development.

- Technology: Outsourcing firms often have access to state-of-the-art technology, reducing the need for your own investment.

Tips for Managing Outsourcing Costs:

- Clear Contract Terms: Ensure that the contract outlines all costs and services clearly to avoid unexpected expenses.

- Regular Reviews: Periodically review the performance of the outsourced provider to ensure they are meeting your needs efficiently.

- Cost-Benefit Analysis: Regularly compare the costs of outsourcing with the potential expenses of managing in-house to ensure continued value for money.

- Flexible Agreements: Choose agreements that allow the flexibility to scale services according to your business cycles.

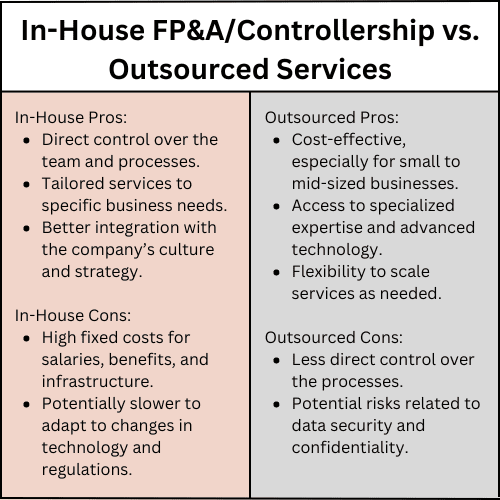

Comparative Analysis

Choosing between in-house and outsourced FP&A/Controllership services depends on various factors, including the size of your business, budget, and strategic priorities. A detailed cost analysis and understanding of your business needs will guide you in making the best decision for your financial management strategy.

By carefully considering the pros and cons and implementing the tips provided, you can optimize your financial planning and control functions to support your business’s growth and success.

Optimize Your Financial Planning

Growing businesses may reach a point where they need the experience, guidance, and knowledge of a senior financial professional but do not need a full-time Controller or Chief Financial Officer. If you find yourself in this situation, we have the solution for you.