Accounts receivable (AR) is a fundamental concept in accounting and finance, especially for businesses that extend credit to their customers. Understanding AR is crucial for new business owners, as it can have significant impacts on cash flow and your company’s overall financial health.

How It Works

AR represents money owed to a business by its customers for goods or services that have been delivered or provided but not yet paid for. These amounts are typically due within a short period, such as 30 or 60 days.

The simplified process uses these five steps.

- Sales on Credit: When a business makes a sale but does not receive payment immediately, it will record the amount as accounts receivable. This essentially means the business has extended credit to the customer.

- Recording in Ledger: The amount is recorded on the balance sheet as an asset because it represents money that the company expects to receive.

- Invoice: The business will typically issue an invoice to the customer, specifying the amount owed, details of the sale, and the due date for the payment.

- Collection: Once the invoice is paid by the customer, the AR for that amount is decreased (or “credited”), and the business’s cash or bank account is increased (or “debited”).

- Aging Report: Over time, it’s beneficial for businesses to review an “aging” report. This report breaks down the AR amounts by how long they have been outstanding. This is useful for assessing the likelihood of collecting older debts and determining if any bad debt write-offs are necessary.

“Each step can be a highly involved process in its own right, especially if your AR team still relies on a high degree of manual workflows,” informed Jennifer Scott, founder HireEffect.

Pitfalls of Traditional AR Processes

If you still rely on traditional AR processes, you might be ready for a more sophisticated solution after reading these pitfalls.

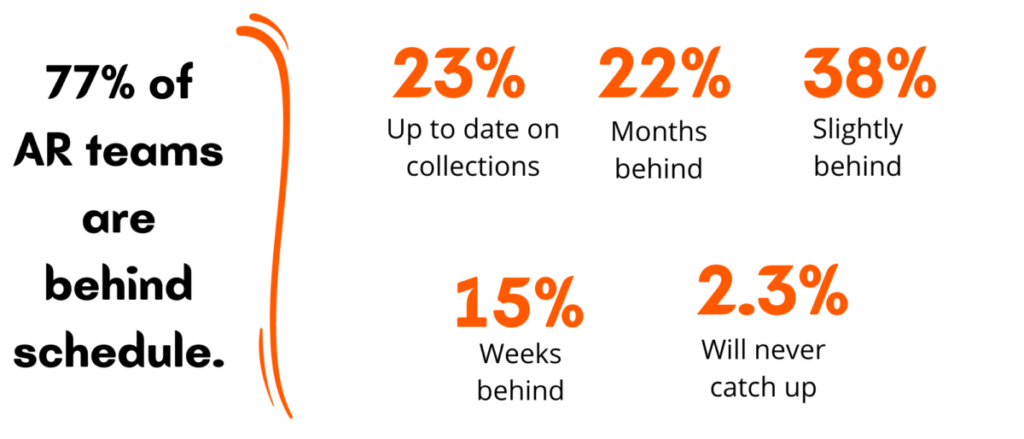

According to a PYMNTS and American Express report, a recent survey finds that AR teams are straining to stay above water in collecting payments on invoices, with many falling weeks or even months behind schedule. Gak!

Wakefield Research surveyed 300 CFOs to learn about their most mission-critical function—invoice processing.

It’s time-consuming and inefficient!

Manually generating and sending invoices takes time, effort, and energy for a staff member. Then, when payments are received, they must manually be collected, verified, and reconciled. Also, the AR staff has to be aware of outstanding accounts to send payment reminders or to start the collection process.

With an automated system, invoices can be sent when the sale is made. Automatic reminders can be programmed and sent to clients. Automation also aids in reducing the average day’s sales outstanding (DSO) and increasing cash flow.

Less Flexible Payment Options

If your manual process prevents you from accepting card payments through an online portal, your invoice-to-cash process could be sluggish. Automated solutions offer customers more features, such as self-service portals, subscription billing, installment payments, and more.

Hard to Scale

If your business is growing and you are looking to scale your AR function, a traditional system might not be up to the task. Time and resources dedicated to manual work and silos could lead to poor customer service and reduced cash flow, especially if the business grows quickly.

Automating the AR Process

If you are sending paper invoices, save yourself time and effort with an automated solution. Here are five benefits of automating your AR processes.

- Improves payment acceptance

- Enhances cash flow

- Improves data accessibility

- Expedites credit approval and management

- Decreases paper usage (and postage costs)

Implications for New Business Owners

- Cash Flow: Even if a business is making many sales, it can run into cash flow problems if customers are slow to pay. Monitoring AR is essential to ensure you have enough cash on hand to cover operational costs and emergencies.

- Bad Debts: Not all AR will be collected. Some customers might not pay at all. If you determine that a debt is uncollectible, it becomes a “bad debt” and needs to be written off, impacting profitability.

- Policies and Procedures: Establish clear credit and collection policies from the start. Determine which customers are eligible for credit, set clear payment terms, and be consistent in following up on overdue accounts.

- Interest and Penalties: Some businesses charge interest or late fees on overdue accounts. If you plan to do this, make sure it’s specified in your sales or service agreements and that it complies with any local regulations.

In summary, AR represents an important asset for many businesses, but it also comes with challenges. Effective AR management can be the difference between thriving and facing serious cash flow issues, so it’s a crucial area for new business owners to understand and manage proactively.

If you are ready to take your business to the next level, reduce invoice costs, and increase cash flow give us a call.