Are you looking to maximize year-end tax savings? Equipment purchases are often a safe bet. According to the IRS, “For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000.”

Where do you record equipment purchases?

Some business owners think equipment purchases are recorded on the income statement. However, that is incorrect. They are recorded on the balance sheet as an increase in the fixed assets line item (as property, plant, and equipment (PP&E) and referenced in the cash flow statement in the investments section.

But what if you purchased equipment for cash?

If purchased for cash, the purchase is recorded on the cash payment journal. In a cash book, there are two sides—debit and credit. On the debit side, record all the business receipt transactions. On the credit side, record the cash payments.

How do I record equipment leases in my books?

In this instance, record the leased equipment as property, plant, and equipment, which is then depreciated over its useful life to the lessee. The lessee must also record a liability reflecting the obligation to make continuing payments under the lease agreement, similar to the accounting for a note payable.

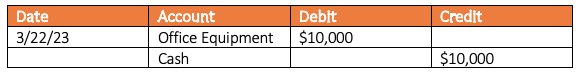

What does an equipment purchase journal entry look like?

When new equipment is purchased, debit the specific equipment (i.e., asset) account. Then, credit the account from which you pay the assets. Remember to change your balance sheet to reflect the additional assets and your cash reduction.

Because equipment is typically a long-term asset, you must record and account for its journey in your business. That includes recording the equipment in your books:

- When you purchase it

- As it depreciates

- When you sell or dispose of it

Example

Let’s say you bought $10,000 worth of office equipment and paid for it in cash. Your journal entry could show a debit for the office equipment and a credit in the cash account.

Do my equipment purchases depreciate over time?

Most equipment purchases do depreciate over time. By recording the depreciation, you offset its decreased value and decrease your taxable income. Basically, it lets you extend the asset costs over the use of the asset.

There are four ways to calculate and record depreciation, including:

- Straight-Line Method in which you spread out the asset costs over the useful life of the equipment.

- Diminishing Balance Method is when a fixed percentage of depreciation is charged in each accounting period to the net balance of the fixed asset under this method.

- Sum of Years’ Digit Method recognizes depreciation at an accelerated rate. That means the depreciable amount of an asset is charged to a fraction over different accounting periods.

- Double Declining Balance Method is a mix of straight line and diminishing balance method. In this case, depreciation is charged on the reduced value of the fixed asset at the beginning of the year. This rate of depreciation is twice the rate charged under the straight-line method. Thus, this method leads to an over-depreciated asset at the end of its useful life compared to the anticipated salvage value.

Save yourself the headache!

You were probably okay with everything until we started talking about depreciation. Don’t worry. We can work with your tax team to provide them with the information needed to help you maximize your deduction.

If you plan to buy equipment before year-end, give us a call.